The AI Platform powering operations and compliance for financial markets

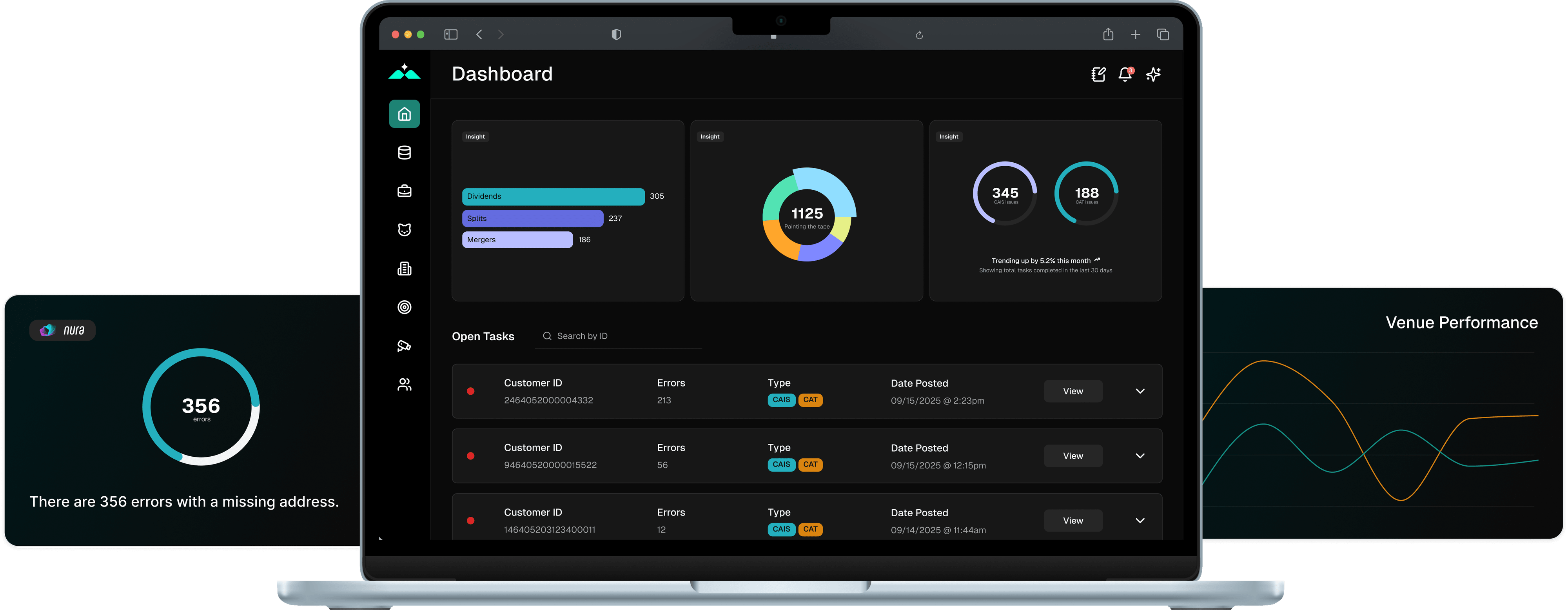

New Range brings compliance, operations, data and reporting together in one intelligent, integrated platform.

Schedule a Demo

Trusted by industry-leading financial enterprises

Firms are drowning in data, reports and regulatory complexity

The stakes are higher than ever. A single reporting error, missed corporate action, or reconciliation break can damage client relationships, trigger audits, and expose your firm to regulatory scrutiny. Meanwhile, your team drowns in alerts, exception handling, and manual reconciliations.

New Range is the smartest compliance platform built for the AI era. We combine machine learning, automated agents, and deep regulatory expertise to transform compliance from a cost center into a competitive advantage.

Key Benefits

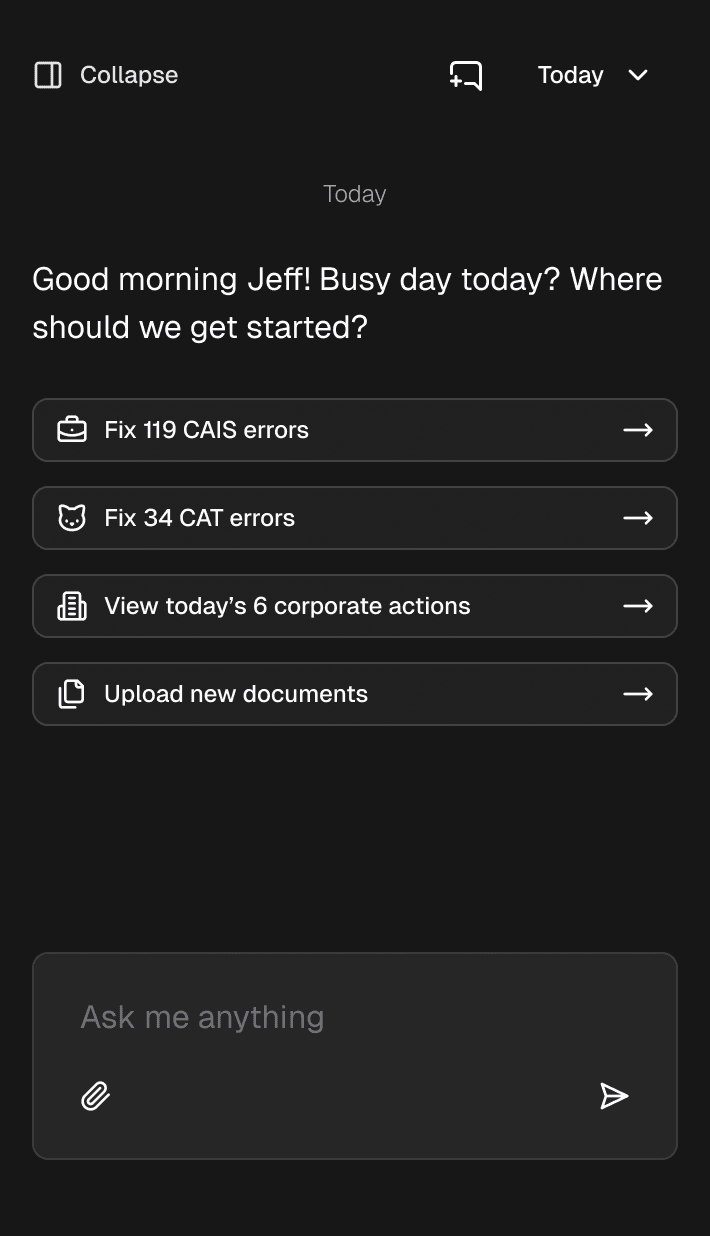

From the fastest growing fintechs to established clearing firms, enterprises trust New Range and its AI agent, Nura, to unify their compliance operations across their firm.

A Unified Platform Built for Modern Financial Firms

CAT & CAIS Supervision & Reporting

Never miss a deadline or submission requirement again. Our platform automatically aggregates trade data, validates formats, identifies exceptions, and submits reports to FINRA CAT and industry participants. Built-in error detection catches issues before submission, while automated reconciliation ensures your records match perfectly with clearing firms and counterparties. Handle order audit trail requirements, customer information fields, linkages, and all reportable events seamlessly.

Best Execution Analysis

Demonstrate regulatory compliance with comprehensive best execution monitoring. Our platform automatically analyzes execution quality across venues, comparing your fills against market benchmarks. Track price improvement, execution speed, and routing effectiveness. Generate SEC Rule 606 reports automatically. Identify routing patterns that may disadvantage customers. Document best execution reviews with audit-ready analysis.

Real-Time Trade Surveillance

Monitor every trade as it happens. Our surveillance engine applies your firm's specific rules and regulatory requirements to flag potentially problematic orders.

Corporate Actions Management

Automate corporate action processing from announcement through allocation so you never miss a beat. Track dividends, stock splits, mergers, spin-offs, rights offerings, and mandatory reorganizations across global markets. Reconcile expected versus actual payments. Maintain comprehensive audit trails showing proper handling of all corporate actions events.

Data Reconciliation Engine

Catch data quality issues before they become compliance problems. Our reconciliation engine continuously compares data across systems - order management, clearing firms, execution venues, customer databases - identifying breaks instantly.

Consolidated Reporting & Analytics

Generate board-ready reports in minutes, not days. Pre-built templates cover CAT submissions, best execution reviews, surveillance summaries, corporate action processing, and reconciliation status. Custom report builders let you create exactly what you need. Interactive dashboards provide real-time insights across all compliance domains.

Bank-Grade Security

Your data security is our top priority. New Range maintains SOC 2 Type II certification, implements strict role-based access controls, and provides detailed audit trails for every action. Privacy mode protects sensitive information while enabling team collaboration.

Tested under real market pressure.

From the fastest growing fintechs to established clearing firms, enterprises trust New Range and its AI agent, Nura, to unify compliance operations across their firm.

View Case Study